Supply and Demand in Today’s Market [INFOGRAPHIC]

KCM • March 14, 2022

Supply and Demand in Today’s Market [INFOGRAPHIC]

Some Highlights

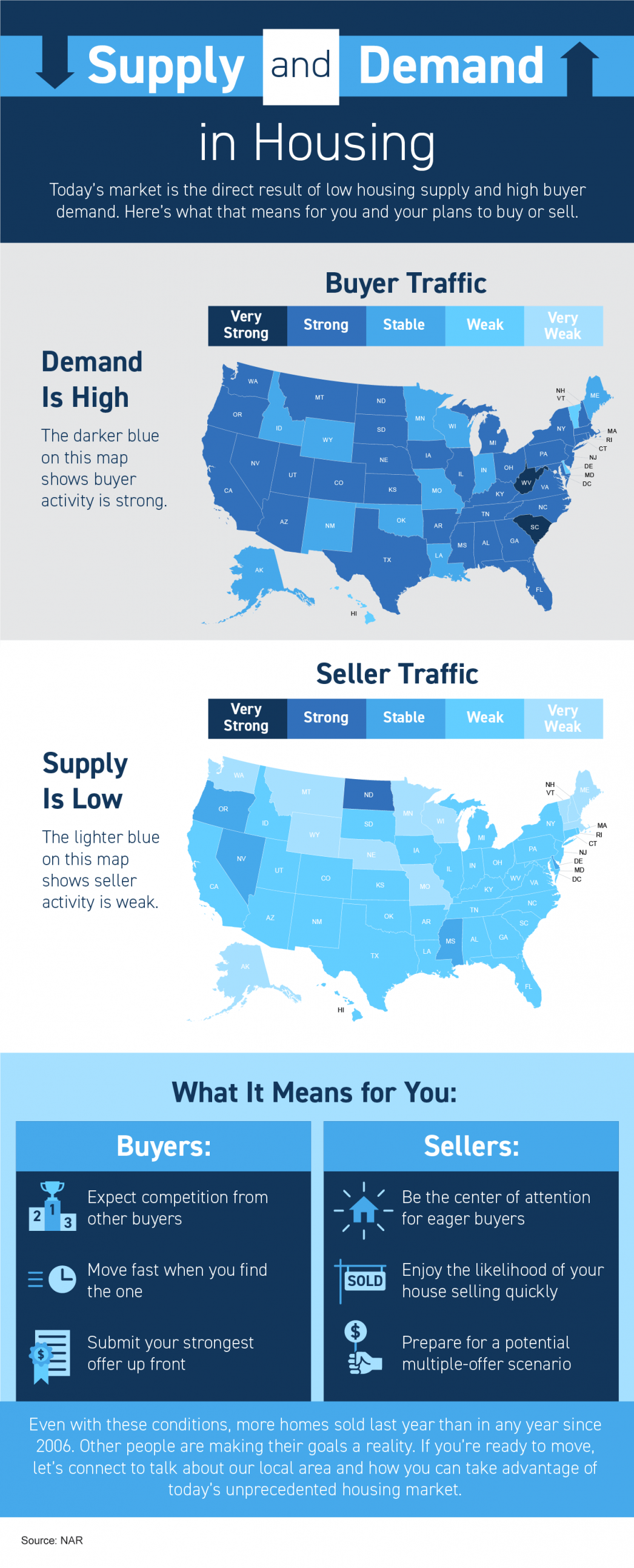

- Today’s housing market is the direct result of low supply and high buyer demand. Here’s what that means for you and your plans to buy or sell.

- For buyers, expect competition, be ready to move fast, and be prepared to submit your strongest offer. For sellers, know your house will be the center of attention and that it’ll likely sell quickly and get multiple offers.

- If you’re ready to move, let’s connect to talk about our local area and how you can take advantage of today’s unprecedented housing market.

Share this post

Top 2026 Housing Markets for Buyers and Sellers W ho doesn’t love a top 10 list? Well, here are two top 10 lists for the housing market this year. But before you take a look, there’s something you should know. If a move is on your radar for 2026, here’s the most important thing you need to understand upfront: there isn’t one housing market this year – there are many. Experts agree 2026 is shaping up to be one of the most geographically split housing markets in years. Some areas are tilting in favor of sellers, while others are opening real doors for buyers. Who has the advantage depends almost entirely on where you are. Selma Hepp, Chief Economist at Cotality, puts it this way: “ Looking ahead to 2026, regional differences will remain pronounced, with demand favoring areas that offer both economic opportunity and relative affordability.” To show just how divided the landscape is, here’s a look at where sellers are expected to have the upper hand, and where first-time buyers may finally find their opening this year. Where Sellers Are Poised To Win Big in 2026 Zillow identified the following metros as some of the strongest seller markets for 2026, based on buyer demand , pricing momentum, and how quickly homes are expected to sell: In markets like these, buyers are going to be competing for limited inventory, which gives sellers more leverage. Homeowners in seller’s markets this year can expect: Stronger buyer interest Shorter time on market Better odds of selling close to (or above) asking price That doesn’t mean every listing is guaranteed success. But it does mean sellers who prepare well and lean on an agent’s expertise should be very happy with their results in 2026. Markets Where There’s More Opportunity for First-Time Buyers On the flip side, here’s a look at where buyers have the power – in particular, first-time buyers , since they’ve had the hardest time breaking into the market lately. Realtor.com highlights the top metros where first-time buyers are expected to have better opportunities in 2026: These markets stand out for a mix of: More affordable home prices Better housing availability Strong local amenities and economic health For first-time buyers, that combination matters. It’s what could finally turn “someday” into “this could actually work.” In buyer’s markets, they should expect: Less intense competition More room to negotiate A clearer path to getting an offer accepted What Matters More Than Any Top 10 List Not seeing your city on the list? Don’t stress. This is just a national snapshot, not a judgment on your local market. The goal here is just to show you how different the market really is depending on where you are. And remember, you can buy or sell no matter how your local market leans. You just need an agent’s help to figure out the right strategy to get it done. For example: A seller in a more buyer-friendly metro may need to be aggressive on their price and prep. A buyer in a seller-leaning area may still need to come prepared with their best offer. To find out where your market falls and what you should expect, you’ll want the help of a local expert. Bottom Line The housing market in 2026 isn’t one-size-fits-all. It’s a year where local conditions matter more than ever. Whether your market leans more buyer-friendly or seller-friendly, the right strategy can put you in a strong position. And that’s where a local expert comes in. Let’s connect.

Why So Many Homeowners Are Downsizing Right Now For a growing number of homeowners, retirement isn’t some distant idea anymore. It’s starting to feel very real. According to Realtor.com and the Census, nearly 12,000 people will turn 65 every day for the next two years . And the latest data shows as many as 15% of those older Americans are planning to retire in 2026. And another 23% will do the same in 2027. If you’re considering retiring soon too, here’s what you should be thinking about. Why Downsize? Now's the perfect time to reflect on what you want your life to look like in retirement. Because even though your finances will be going through a big change, you don’t necessarily want to feel like you’re living with less . But odds are, what you do want is for life to feel easier . Easier to enjoy. Easier to manage. Easier to maintain day-to-day. The Top Reasons People Over 60 Move You can see these benefits show up in the data when you look at why people over 60 are moving. The National Association of Realtors (NAR) finds the top 4 reasons aren’t about timing the market or chasing top dollar. They’re about lifestyle: Being closer to children, grandchildren, or long-time friends so it’s easier to spend more time with the people who matter most Wanting a smaller, more functional home with fewer stairs and easier upkeep Retiring and no longer needing to live near the office, so it’s easier to move wherever you want Opting for something smaller to reduce monthly expenses tied to utilities, insurance, and maintenance No matter the reason, the theme is the same: downsizing isn’t about giving something up. It’s about gaining control and choosing simplicity. And it brings peace of mind to know your home fits the years ahead, not the years behind. And the best part? It’s more financially feasible now than many homeowners would expect. The #1 Thing Helping So Many Homeowners Downsize Here’s the part that makes it possible. Thanks to how much home values have grown over the years, many longtime homeowners are realizing they’re in a stronger position than they thought to make that move. According to Cotality , the average homeowner today has about $299,000 in home equity . And for older Americans, that number is often even higher – simply because they’ve lived in their homes longer. When you stay in one place for years (or even decades), two things happen at the same time: Your home value has time to grow. Your mortgage balance shrinks or disappears altogether. That combination creates more options than you’d expect, even in today’s market. So, whether you just retired, or you're about to, it's not too soon to start thinking about what comes next. Sure, it can be hard to leave the house you made so many years of memories in, but maybe it’s time to close one chapter to open a new one that’s just as exciting. Bottom Line Downsizing is about setting yourself up for what comes next – on your terms. If retirement is on the horizon and you’ve started wondering what your current house (and your equity) could make possible, the first step isn’t selling. It’s understanding your options. Let’s talk. A simple, no-pressure conversation can help you see what downsizing might look like – and whether it makes sense for you.