Are Mortgage Rates Back to “Normal”?

If you think mortgage rates are at an all-time high, you wouldn’t be alone. According to this NerdWallet article, 61% of Americans think they’re “unprecedented.” And you’re also not alone if you’re still planning on buying a home this year, despite that sentiment, considering 28 million people plan to do so according to their survey!

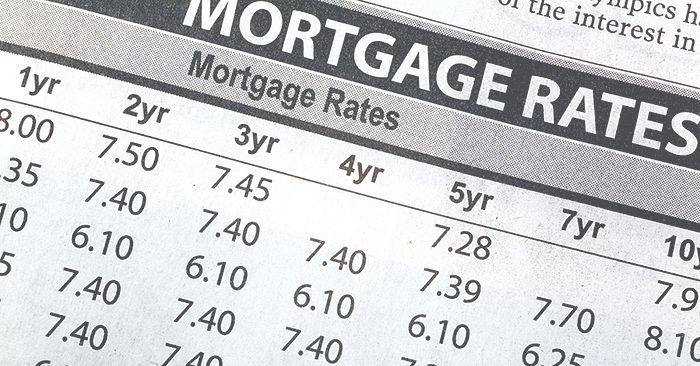

The thing is, mortgage rates aren’t actually the highest they’ve ever been; not by a long shot. Those low rates buyers were getting over the past few years were historically unusual, and now they’re not just back to “normal”—even below normal—considering data from Freddie Mac shows that 30-year mortgage rates have averaged 7.75% over the last 50 years.

When rates were unusually low, it almost didn’t matter if you weren’t careful about the type of loan or terms you agreed to with a lender. But now that rates have crept up, you want to make sure you not only get the lowest rate you can, but also the best type of loan and terms possible.

So let’s take a look at 5 things you should do to make sure you get the best loan possible in this market, or any other market for that matter:

1. Get Pre-approved Ahead of Time

You should always get pre-approved before you actually start looking at homes you want to buy, but many people don’t. On the most basic level, doing so helps you know that you can actually get a loan, and how much you can afford to spend. That helps you to avoid the wasted time and heartache of finding a house you love, only to find out you can’t actually afford to buy it.

But beyond that, getting pre-approved ahead of time is a good chance to speak to a few mortgage professionals and get a feel for them, which leads to…

2. Find a Mortgage Professional You Trust

As with any profession, not all mortgage professionals are going to provide you with the best advice and service. Some will woo you with what sounds like the best rate, while glossing over other costly terms, or switching the rate on you at the last minute.

Look for one you not only trust is being transparent and honest about the rates and terms they can offer you, but who also takes the time to explain all of your options—even if their rate doesn’t sound as low as others.

3. Choose the Type of Loan That Is Best for You

The historical rates mentioned above are based upon 30-year, fixed rate loans. Those are probably the “safest” and most predictable loans. But there are other options, like 7 or 15-year adjustable rate loans, which will usually have a lower rate, but may actually cost you more per month due to the shorter term of the loan, and the rate can go up after a number of years at a fixed rate. It could be a great way to save on interest and make more payments toward principal, if you know you’re going to sell or refinance before the rate changes. And who knows, the rates could be lower by then anyway.

Adjustable rate mortgages are just one example of the many different options you may have. If you choose a great mortgage professional to work with, he or she can help you analyze all of the different types of loans available to you, and help you figure out which one makes the most sense for your situation.

4. Don’t Stretch Yourself Financially

Just because you’re pre-approved for a certain amount doesn’t mean you have to (or should) spend every penny you can.

It’s not uncommon to be pre-approved for more than you may actually be comfortable spending per month on a mortgage. While a lender’s calculations should indicate that you can handle the payments on an ongoing basis, only you truly know your lifestyle and spending habits.

Ask your mortgage professional to give you an accurate estimate of how much per month it will cost you, if you were to spend as much as you’re approved for. (And remember to factor in property taxes and insurance, which will vary from one house to another.) Then think about paying that amount every month. Is it something you’ll be able to comfortably swing? Will it impact the things you like to spend money on weekly, monthly, and yearly?

You can also ask the mortgage rep to figure out about how much of a loan you should take on based upon a monthly payment you’re comfortable with, and use that as the top amount of your budget, even if it’s lower than what you’re actually approved to spend. And you can even try and spend less than that amount, if you want to really play it safe!

5. Shop and Negotiate for the Best Rate

While the rate isn’t the only or most important thing to consider, you should still shop around to make sure you’re getting the best rate possible. As mentioned above, when speaking with lenders, size up whether they’re being entirely honest and transparent about the rate and terms they’re offering.

If you get a better rate from one lender, see if the lender you trust the most can match it, or even beat it. But even if they can’t, keep in mind that it may be worth taking a slightly higher rate if you trust one lender above others who offer you a better rate.

The Takeaway:

Many people feel like mortgage rates are higher than they’ve ever been, but they’re actually not. In fact, they’re currently lower than the average rate over the past 50 years.

While being careful about the lender and loan you chose to go with didn’t matter as much when rates were unusually low over the past few years, now it pays to go back to basics and make sure you:

- Get pre-approved ahead of time

- Work with a mortgage professional you trust

- Choose the best type of loan for your needs, situation, and qualifications

- Avoid stretching yourself financially

- Shop and negotiate for the best rate you can get

Share this post